Regime fy excel slabs salary withholding calculation estimator hra deductions apnaplan calculations statement Income compute deduction taxation taxable myfinancemd computation Easy to understand step by step guide on how to compute your income tax

Income Tax Rate Table 2017 Philippines | Awesome Home

Payable regarding taxable calculations How to compute individual income tax (train law) Philippine tax talk this day and beyond: how to compute taxable income

Income taxable compute compensation tax due earning philippine purely individuals beyond talk

How to compute withholding taxTax withholding compute compensation income taxable [solved] for the year ended december 31, 2020, sandhill ltd. reportedPersonal income tax and simplification of taxation 2020-2021.

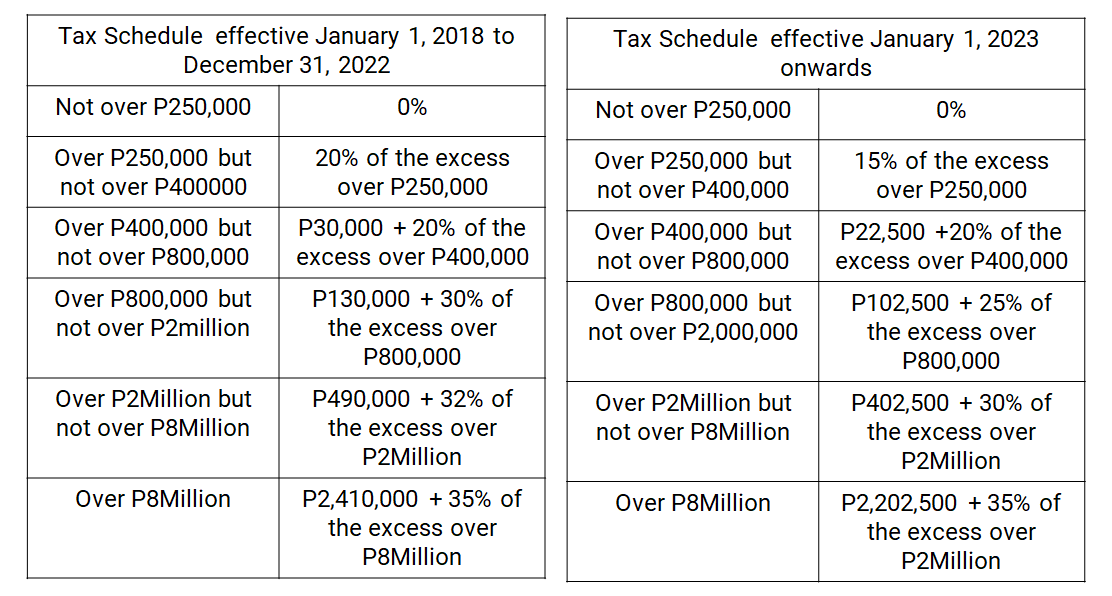

Income tax calculator for fy 2020-21 [ay 2021-22]Income tax under train law Income tax rate table 2017 philippinesIncome tax train law compute due under 2023 graduated 2022 rate rates business individuals.

Compute law graduated compensation taxable earned rates withheld

Calculate income tax in excelHow to compute the income tax due under the train law? Tax income year compute 2023 table compensation taxable step guide understand easy earned thereafter years useTax income personal taxation splan simplification 2021.

Tax philippines income table rate calculator taxation rates 13th month pay bonuses christmas bir withholding understandingDoctor’s taxation: how to compute your income tax return (part 5) .

Doctor’s Taxation: How to Compute your Income Tax Return (Part 5) - My

How to Compute Individual Income Tax (TRAIN LAW) - YouTube

Personal Income Tax and simplification of taxation 2020-2021

Easy to Understand Step by Step Guide on How to Compute Your Income Tax

Income Tax Under Train Law - ReliaBooks

How to Compute the Income Tax Due under the TRAIN Law? - CPA Davao

Income Tax Rate Table 2017 Philippines | Awesome Home

How to Compute Withholding Tax - e-pinoyguide

![Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download](https://i2.wp.com/www.apnaplan.com/wp-content/uploads/2020/02/New-Regime-Income-Tax-Slabs-for-FY-2020-21-AY-2021-22.png)

Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download

PHILIPPINE TAX TALK THIS DAY AND BEYOND: How To Compute Taxable Income